DURING CALENDAR year 2023 quarterly results discussions, blockbuster dealmaking took centre stage for India’s top IT players. Despite the spotlight, the financial payoff has yet to materialise amid a slump in discretionary spending throughout the year.

The $250-billion Indian IT services sector is unmistakably bracing for a near-term slowdown, influenced by restrained tech investments in the US and European markets grappling with high interest rates and inflation. This is reflected in consistent revenue guidance cuts across major IT players as they deal with tough market conditions. Complicating matters, global disruptions like Russia’s prolonged war in Ukraine and the Israel-Hamas conflict add another layer of complexity to an already challenging landscape.

In a note in October, JP Morgan analysts said that investors had assumed FY24 to be a washout and shifted focus to FY25, hoping for a rebound. With two quarters still to go in FY24, the situation looks pretty grim for the sector.

Guidance Takes A Hit

Infosys revised its FY24 revenue growth guidance from 1 per cent-3.5 per cent in Q1 FY24 to a narrower range of 1 per cent-2.5 per cent in Q2 FY24, citing challenges such as reduced discretionary spending and delayed decision-making in an uncertain macro-environment. On similar lines, HCLTech, which had initially projected 6-8 per cent constant currency revenue growth for FY24, adjusted its guidance to 5-6 per cent in Q2. Despite this, the company maintained its 18-19 per cent operating margin target.

This story is from the January 13, 2024 edition of BW Businessworld.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the January 13, 2024 edition of BW Businessworld.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In

Technology, AI Driving Warehousing Sustainability

Anshul Singhal on how Welspun One is rapidly transforming Grade-A logistics and industrial parks across India, offering integrated fund development and asset management for large-scale warehousing solutions

DECODING RETAIL'S NEXT FRONTIER

As brands pivot towards omnichannel ecosystems and startups challenge legacy frameworks, the focus sharpens on experiential retail, sustainability and data-driven personalisation.

SORORITY OF WOMEN OF METTLE

Awinter afternoon in mid-December found quite a crowd at the Oxford Book Store on Connaught Place, as bibliophiles congregated at a corner to listen to three women authors, diverse in their passions, but drawn together by an urge to tell their story.

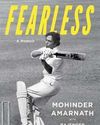

THE LEGACY OF THE AMARNATHS

IN NOVEMBER 2017 the management committee of the Delhi Cricket Association named the eastern stand of the Feroze Shah Kotla ground the Mohinder Amarnath stand.

PUTTING THE POWER IN THE POWERHOUSE

The Asus ExpertBook P5 is powered by an 8-core 8-thread Intel Core Ultra 7 Series 2 processor that clocks a maximum speed of 4.8 GHz, but it does not have hyperthreading. It is light weight, with a smooth glass touch pad. The laptop almost has all the I/O ports you could possibly need in a business laptop, making it an extremely lucrative option for professional computing, says

"We must be aware of our energy and water consumption"

BW Businessworld caught up with actor, philanthropist, and climate warrior BHUMI PEDNEKAR to chat about climate change and more.

"Cooking is a passport to the world"

In conversation with renowned CHEF MANJIT GILL, Advisor at Kikkoman India and President, Indian Federation of Culinary Associations (IFCA). As the former Corporate Chef of ITC hotels, Chef Gill has helped shape iconic restaurants, such as the Bukhara, Dum Pukht, and Dakshin. He has had the privilege of serving former American Presidents Barack Obama, Bill Clinton, George Bush, and the French, Canadian, British and German premiers. In 1992, Chef Gill had the opportunity of being invited to cook for Prince Charles and Lady Diana, at the Palace of the Maharaja of Jaipur. He was awarded the Lifetime Achievement Award from the Ministry of Tourism in 2007.

Strengthening Middle Management for Organisational Resilience

WHAT HOLDS AN organisation together in chaos? Is it visionary leadership, cuttingedge strategies, or robust technology?

The Retail Trailblazers

A look at companies that are making a positive impact on India's growing retail sector with their future fit business and marketing strategies.

Driving Conscious Consumerism

VIDIT JAIN, Co-founder of Kindlife, is leading the charge in revolutionising the intersection of technology and conscious consumerism.