WEALTH INEQUALITY—and specifically the yawning racial wealth gap (the median black family has about one-tenth the net worth of a white household)—is a thorny challenge for U.S. policymakers. One solution increasingly discussed by progressive politicians but seen as lacking popular support would be for the government to pay reparations to black Americans for the wealth lost during generations of slavery and discrimination.

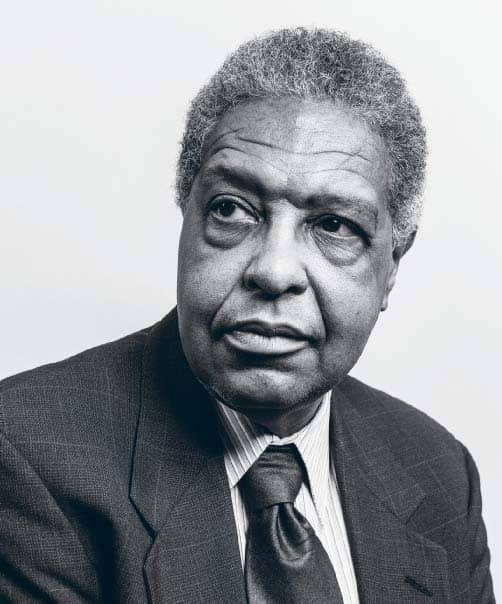

Duke University professor William “Sandy” Darity and his onetime student Darrick Hamilton, currently serving as director of Ohio State University’s Kirwan Institute for the Study of Race and Ethnicity, have proposed an interim step dubbed “baby bonds.” The bonds, averaging $25,000 but rising to as much as $60,000 for the poorest children, would be federally managed to increase by a guaranteed annual rate of 2 percent. The cost of up to $100 billion would be less than 3 percent of the U.S. budget. As they explain to Bloomberg News’s Matthew Boesler, the bonds would seek to minimize the wealth disparity between the richest and the poorest, regardless of race.

MATTHEW BOESLER: What are baby bonds, and how would they work?

SANDY DARITY: The language “baby bonds” is kind of a cute touch that was inspired for us by the late [Columbia University professor] Manning Marable. But really what we’re talking about is a trust account—a federally funded trust account—for each young person that they could access when they reach young adulthood.

DARRICK HAMILTON: It basically is about setting up an account at birth, seeded with an endowment, based on the wealth position one is born into. That can be used when you become a young adult toward some asset-enhancing endeavor, like a debt-free education, or as capital to purchase a home or start a business. The source of inequality is, especially at the median, determined by the fact that some Americans have access to some seed capital to put into an asset that will passively appreciate over their life. And I think the key word is passive. It has very little to do with something behavioral. They have some capital with which they can take part in the financial markets.

MB: How does race play into this?

This story is from the April - May 2019 edition of Bloomberg Markets.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the April - May 2019 edition of Bloomberg Markets.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In

See Which Countries Are Falling Behind On Climate Change

Under the Paris Agreement, 190 countries and the European Union pledged to take steps to hold the global temperature rise to less than 2C (3.6F) from preindustrial levels—and preferably 1.5C.

Billionaires Vie for the Future of Brazilian Finance

An escalating battle between two billionaires is upending the financial community in São Paulo, Latin America’s wealthiest city.

Ford Foundation's Darren Walker: ‘We Have to Get Uncomfortable'

DARREN WALKER, 62, disrupted his Wall Street life more than 25 years ago when he left what is now UBS Group AG to volunteer at a school and eventually pursue a career in community development and philanthropy. Since 2013 he’s been at the pinnacle of the philanthropic world as president of the Ford Foundation, created by the family of automaker Henry Ford during the Great Depression to advance human welfare.

Fueling the Ener Transition

I MAY BE BIASED, but some of the most important research and data on the Bloomberg terminal lies in one of its lesser-known functions: {BNEF }

Dig Into Analysts' Estimates for Disruptive Companies

THE PANDEMIC ERA generated a whole wave of disruptive companies as it accelerated the introduction of new products and services in areas including artificial intelligence, digitization, electronic payments, online meeting platforms, and virtual currencies.

Climate Risks Come for Sovereign Credit

FOR YEARS climate scientists have warned about the ferocious wildfires and hurricanes that are now overwhelming many communities. Today alarms are ringing about a related financial danger: risks lurking within government bonds, the biggest part of the global debt market.

Responsible-Investing Pioneer Lydenberg Says ESG Needs An Upgrade

STEVE LYDENBERG’S passion for social change was inspired by anti-Vietnam War demonstrations, consumer boycotts, and the movement to divest from apartheid South Africa. But he didn’t take to the streets. Instead, Lydenberg turned to the world of finance to help catalyze societal change.

Engine No. 1's Grancio: ‘People Will Appreciate an Economic Argument'

ENGINE NO. 1 sent shock waves across corporate America in May when the fledgling investment firm won a boardroom battle with Exxon Mobil Corp., securing three seats on the oil and gas giant’s board after purchasing only about $40 million of its stock.

Find Out Which Companies May Ramp Up Payouts After Covid

AS THE PANDEMIC DISRUPTED business last year, many companies cut or suspended dividends. Which will boost their payouts when economies pick up again?

Get Into the Minds of Central Bankers as They Navigate Shocks

HAVE YOU EVER WONDERED how central bankers forecast the impact of shocks on the economy?