• Choose a mutual fund: First, you need to choose the mutual fund in which you want to start an SIP. You can consider factors such as

• Your financial goals,

• Asset Allocation as per financial goals and risk tolerance,

• Investment horizon, and

• Track record / portfolio positioning of the mutual fund while making your selection.

• Complete Know Your Customer (KYC) process: To invest in mutual funds in India, you need to complete the KYC process. You can do this by submitting the required documents including a photograph, identity proof, address proof, and PAN card to the mutual fund company or through any of the KYC registration agencies authorized by the Securities and Exchange Board of India (SEBI).

This story is from the October 21, 2023 edition of Outlook.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the October 21, 2023 edition of Outlook.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In

No Singular Self

Sudarshan Shetty's work questions the singularity of identity

Mass Killing

Genocide or not, stop the massacre of Palestinians

Passing on the Gavel

The higher judiciary must locate its own charter in the Constitution. There should not be any ambiguity

India Reads Korea

Books, comics and webtoons by Korean writers and creators-Indian enthusiasts welcome them all

The K-kraze

A chronology of how the Korean cultural wave(s) managed to sweep global audiences

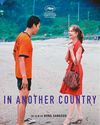

Tapping Everyday Intimacies

Korean filmmaker Hong Sang-soo departs from his outsized national cinema with low-budget, chatty dramedies

Tooth and Nail

The influence of Korean cinema on Bollywood aesthetics isn't matched by engagement with its deeper themes as scene after scene of seemingly vacuous violence testify, shorn of their original context

Beyond Enemy Lines

The recent crop of films on North-South Korea relations reflects a deep-seated yearning for the reunification of Korea

Ramyeon Mogole?

How the Korean aesthetic took over the Indian market and mindspace

Old Ties, Modern Dreams

K-culture in Tamil Nadu is a very serious pursuit for many