In May 2022, soon after geopolitical concerns took centrestage and the Covid threat started abating, the Reserve Bank of India (RBI) increased repo rates for the first time after 31 months to control inflation. Ever since, RBI has been on a rate hike spree, pausing only recently in April 2023, with an indication that this may not be the end of the rate hike cycle yet.

In the last one year, the central bank has raised interest rates by 2.5 per cent or 250 basis points (bps), and repo rates have reached the 6.50 per cent level after four and a half years. The 2.5 per cent number may not look alarming, but it has left a trail of misery for borrowers who have seen equated monthly instalments (EMIS) go up by a huge 20 per cent for a home loan amount of ₹50 lakh over a period of 20 years, at the cost of compromising with other expenses or remaining indebted for a longer period.

The recent policy action by RBI has kindled some hope. The pause in rate hikes in the first bimonthly policy announcement for financial year 2023-24 has given rise to the cautious expectation that EMIs may not go up further, stopping short of being optimistic about a rate cut.

The development throws up key issues for borrowers, both new and existing. The first, of course, is where are the interest rates headed. The second is relevant for new borrowers who may have been waiting for a rate hike pause and would now be wondering if the time is right for them to take the plunge. The third involves existing investors, who need to put a strategy in place if they haven't done so already, especially now that they may not have to realign their cash flows every two months with every RBI monetary policy announcement. Before dealing with those, we take stock of the pain the rate hikes have caused over the past year.

This story is from the June 2023 edition of Outlook Money.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the June 2023 edition of Outlook Money.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In

HOW TO BEAT CURRENCY EXCHANGE RATE WOES

If you are travelling abroad, you will have to change your Indian rupees into either dollars or euro or to the local currency. Here's how to choose the right currency for a seamless holiday experience abroad

Why A New Year Goal Is Good

Setting a new year goal can give you a psychological boost to improve yourself and help you set aims and targets while also helping you declutter and let go of the past

SENIOR CITIZEN HOUSING: THE HURDLES TO CROSS

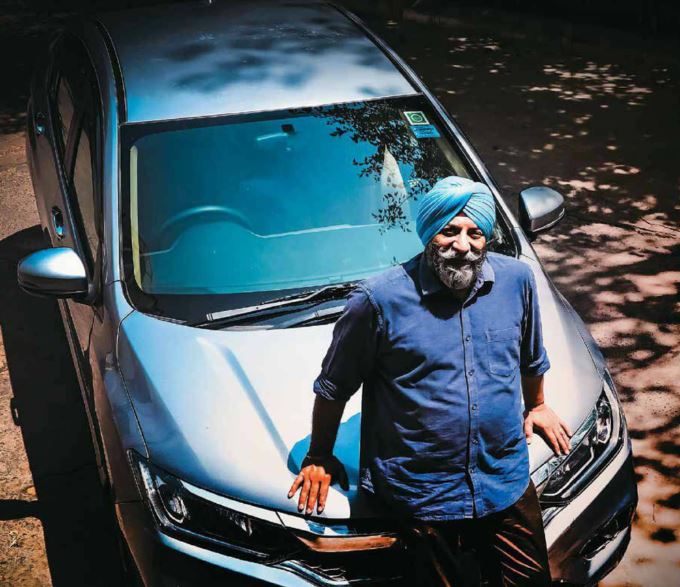

Buying a home is not only a dream of youngsters, many retirees also want to buy a home, but for that, they have to overcome adverse situations and many challenges

Axing Taxes And Beating Benchmarks

When investing for the long term and that too in a product with a lock-in period, the decision between the best and the consistent performer becomes critical.

Use Gold To Optimise Portfolio

Returns from gold are expected to be decent going forward, but more importantly, it acts as a portfolio diversifier and helps reduce volatility

The Risks That Invoice Discounting Entails

Invoice discounting can give potential high returns over a short period of time, but lack of regulation make them a high-risk investment

2024: CHANGES THAT MATTER

The year 2024 has been a game-changer for the Indian regulatory landscape, with the Securities and Exchange Board of India (Sebi), Insurance Regulatory and Development Authority of India (Irdai), the Reserve Bank of India (RBI), the Pension Fund Regulatory Development Authority (PFRDA) and the Income Tax Department proposing key changes that will benefit investors, policyholders, pensioners, taxpayers and consumers alike. We give you a lowdown on five key changes proposed by each of these regulators

10 Stock Picks For 2025

Top analysts recommends 2 stocks each and the reasons why they should be a part of your portfolio

VOLATILITY AHEAD: PLAY SAFE

After an exhilarating rally till September 2024, the Indian stock market finds itself in turbulent waters and is expected to continue to do so in 2025. We give you some stock picking strategies that will help you play safe. We also have a list of 10 stocks recommended by experts which you can consider for your portfolio

Stay Ahead Of AI-Powered Cyber Fraud

AI has become an integral part of our lives, right from customer service at banks to insurance claims. But it has now become a powerful arsenal for the fraudsters too who are increasingly using AI to scam individuals and corporations alike to commit fraud. The key is to stay vigilant