Sanjiv Bajaj Jt. Chairman & MD, Bajaj Capital

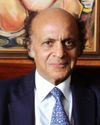

Deepak Mohanty Chairperson of the Pension Fund Regulatory and Development Authority

"NPS, in essence, is a vehicle that empowers individuals in the private sector to plan for their retirement. It's a means for people to create a financial cushion for their post-retirement life, ensuring they can enjoy a comfortable and secure lifestyle when their working years conclude."

In the world of Indian finance, Deepak Mohanty stands tall as a prominent figure. Serving as the chairperson of PFRDA, he wields significant influence in shaping India's financial landscape.

We are honored to have him here today for an enlightening interview.

Before we dive into our conversation, let's take a moment to discuss the National Pension System (NPS), a financial tool that has been gaining popularity in India. While some have fully embraced NPS, others have yet to explore its potential. NPS provides a unique way for investors to nurture their retirement dreams and build an extra income source. Deepak Mohanty often stresses the concept of a second income, a financial safety net that ensures one's lifestyle remains secure, even during unexpected events like lockdowns.

Today, we are privileged to hear from Deepak Mohanty, a distinguished figure who has made significant contributions to the Indian economy, particularly through his work with the Reserve Bank of India (RBI). Let's begin by discussing the current state of the Indian economy. Our Prime Minister has set an ambitious goal for India to become the world's third largest economy during his third term. This vision not only paints a hopeful picture but also offers opportunities for wealth creation. Given Deepak Mohanty's extensive experience and expertise, we eagerly await his insights into the Indian economy at this critical moment.

This story is from the September 2023 edition of Investors India.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the September 2023 edition of Investors India.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In

A Doctor Within You: Your Immune System

The fact that you survive is due to your immune system-a fascinating network of chemicals and cells that protect your body.

PERSON OF THE YEAR 2024

Like every year there were many contenders. Don is back dodging bullets by the ear. He can claim the year. Criminal convictions?

Indian Mutual Fund Industry in 2025 What Lies Ahead?

Q. How do you view the performance of the MF industry, in general, and your fund house, in particular, during 2024?

Add Health to Your Wealth

Life is unpredictable because it is influenced by countless unpredictable factors such as accidents, illness, economic changes, natural disasters or personal circumstances.

Market strategy for the year 2025

India’s GDP print came in lower than expectations at 5.4% substantially lower than 6.7% recorded in Q1 FY’25 and 8.1% in Q2 FY’24 seems mainly by a slowdown in government expenditure and capital formation.

Review and Rebalance Your Portfolio at the Start of 2025

At the start of 2025, investors must review their investment portfolios and bring about certain changes to prepare them for the challenges of the new year. Let us begin by reviewing the year that has gone by, and then discuss the changes you need to make to your portfolio.

An Overview on Asset Allocation

The recent sharp volatility in the stock markets has retail investors worried, especially those who put all their funds into equity and completely ignored fixed income/debt and gold.

Indians are Developing Weak Bones

In India, 1 out of 8 males and 1 out of 3 females suffer from osteoporosis, making India one of the largest affected countries in the world.

"The strategy behind the Tata India Innovation Fund centers on identifying companies that are driving transformative or incremental changes through innovation"

Yes, we certainly believe innovation is a powerful theme with immense potential for the coming years, and we are excited to bring it to our investors.

What is Hybrid Mutual Fund?

Hybrid Mutual Fund is a combination of more than one type of fund. While they invest in shares of companies listed on the exchange, like equity funds.