CATEGORIES

Categories

AI IS BECOMING INGRAINED IN BUSINESSES ACROSS INDUSTRIES.WHERE IS IT GOING IN 2025?

As artificial intelligence continues to grow at a rapid pace, more and more businesses are grappling with how to adapt both quickly and responsibly.

NVIDIA'S NEW GPU SERIES LED AN AVALANCHE OF ENTERTAINMENT-RELATED ANNOUNCEMENTS AT CES

In a packed Las Vegas arena, Nvidia founder Jensen Huang stood on stage and marveled over the crisp real-time computer graphics displayed on the screen behind him. He watched as a dark-haired woman walked through ornate gilded double doors and took in the rays of light that poured in through stained glass windows.

BIGGEST NVIDIA TAKEAWAYS FROM JENSEN HUANG'S CES 2025 KEYNOTE

Nvidia CEO Jensen Huang unveiled a suite of new products, services and partnerships at CES 2025

FROM AI ASSISTANTS TO HOLOGRAPHIC DISPLAYS, AUTOMAKERS SHOWCASE IN-CABIN EXPERIENCES AT CES

Interior lighting aimed at reducing motion sickness. Shiny holographic dashboards displayed on windshields. And Al-powered voice assistants paired with infotainment systems to keep you company on long drives.

A NEW NEUTRINO DETECTOR IN CHINA AIMS TO SPOT MYSTERIOUS GHOST PARTICLES LURKING AROUND US

Underneath a granite hill in southern China, a massive detector is nearly complete that will sniff out the mysterious ghost particles lurking around us.

NEW LABELS WILL HELP PEOPLE PICK DEVICES LESS AT RISK OF HACKING

The federal government is rolling out a consumer labeling system designed to help Americans pick smart devices that are less vulnerable to hacking.

TIKTOK CREATORS LEFT IN LIMBO WHILE AWAITING DECISION ON POTENTIAL PLATFORM BAN

Will TikTok be banned this month?

IN 2024.ARTIFICIAL INTELLIGENCE WAS ALL ABOUT PUTTING AI TOOLS TO WORK

If 2023 was a year of wonder about artificial intelligence, 2024 was the year to try to get that wonder to do something useful without breaking the bank.

10 TIPS FROM EXPERTS TO HELP YOU CHANGE YOUR RELATIONSHIP WITH MONEY IN 2025

Now that 2025 is here, you might be reflecting on your financial goals for the year.

AI IS A GAME CHANGER FOR STUDENTS WITH DISABILITIES.SCHOOLS ARE STILL LEARNING TO HARNESS IT

For Makenzie Gilkison, spelling is such a struggle that a word like rhinoceros might come out as “rineanswsaurs” or sarcastic as “srkastik.”

APPLE TO PAY $95 MILLION TO SETTLE LAWSUIT ACCUSING SIRI OF EAVESDROPPING

Apple has agreed to pay $95 million to settle a lawsuit accusing the privacy-minded company of deploying its virtual assistant Siri to eavesdrop on people using its iPhone and other trendy devices.

FLYING TAXIS ARE ON THE HORIZON AS AVIATION SOARS INTO A NEW FRONTIER

When he was still a boy making long, tedious trips between his school and his woodsy home in the mountains during the 1980s, JoeBen Bevirt began fantasizing about flying cars that could whisk him to his destination in a matter of minutes.

Macs Unified

THE M4 CHIP LINEUP WE'VE BEEN EXPECTING FOR OVER A DECADE

WWE READY TO BEGIN NETFLIX ERA WITH 'MONDAY NIGHT RAW' MOVING TO THE STREAMING PLATFORM

Nick Khan's prediction becomes a reality on Monday night.

FUBO COMBINING WITH DISNEY'S HULU + LIVE TV: LAWSUIT AGAINST VENU SPORTS SETTLED

Disney's Hulu + Live TV and sports streaming service Fubo are combining in a deal that will also see the settlement of a lawsuit against the creation of Venu Sports.

'Get Out, Get Out Now'

The fire rose from the bone-dry hills, as so many others have, and then rapidly tore across the coast and hills of one of America's most famous cities-oblivious to the demographics of the lives it disrupted. It burned mansions in Malibu and low-income housing in Pasadena.

OpenAI CEO Altman Denies Sister's Sexual-Abuse Claims

OpenAI Chief Executive Sam Altman is being sued by his sister over allegations that he sexually abused her for several years when they were children. Altman denies the accusations.

A Solitary Samurai Born of Collaboration

One reason movie lovers the world over hold the filmmaker Akira Kurosawa in such high regard is that he instilled visceral excitement into Japanese cinema as no one had before him. Whether he was more influenced by Hollywood or the other way around remains debated. But what isn't in doubt is the hold his pictures had-and continue to have-on audiences since his international breakthrough, the landmark \"Rashomon\" (1950).

Keep Performance Notes To Bolster Career Goals

If you're angling for a raise or a promotion this year, do this one thing before anything else: Start taking notes.

Americans Toast French Flour

Some bakers, and bread-lovers with gluten sensitivity, swear by the more expensive import

Ringo Starr's Twangy Turn

The former Beatle highlights his love of country music on an album produced by T Bone Burnett

Social-Media Giants Retreat on Policing Speech

Social-media companies never wanted to aggressively police content on their platforms. Now, they are deciding they don't have to anymore.

Panama Canal Chief Rebuts Claims About China, Shipping Rates

The leader of the Panama Canal Authority denied President-elect Donald Trump's claims that China is controlling the vital trade route, and said Trump's suggestion that U.S. ships get preferential rates \"will lead to chaos.\"

Israel Says Dead Hostage Found With Captors' Bodies

The Israeli military said it had retrieved the body of a hostage who had been held in the Gaza Strip, as the Biden administration struggles to secure a deal that would pause the fighting between Israel and Hamas, and bring home dozens of hostages still in captivity before President-elect Donald Trump's inauguration.

Xi Muzzles Economist In Drive To Silence Criticism

A prominent Chinese economist raised doubts about Beijing's economic management at a Washington forum in December and said China's economy might have grown at less than half the roughly 5% pace flaunted by authorities.

Riches, Routes Draw Trump to Greenland

President-elect Donald Trump has set his sights on a vast, ice-covered and sparsely populated island with a strategic location on the edge of the Arctic and a whole lot of mineral riches.

'Nosferatu' Upends the Modern Vampire

In \"Nosferatu,\" Robert Eggers's new take on the classic vampire-horror film, there are no heart-throbs who glisten in the sun like Edward Cullen in \"Twilight\" or smolder like Lestat in \"Interview With the Vampire.\"

Defense Industry Is Booming in Israel

Regional war, quest for aerial-defense systems fuel a surge despite embargoes

Billionaire Leon Black in Talks To Back Bid for U.K.'s Telegraph

Leon Black, the co-founder and former chairman and chief executive of Apollo Global Management, is in talks to become the anchor investor behind the planned purchase of the U.K.'s Daily Telegraph newspaper.

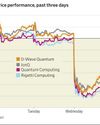

Quantum Stocks Sink On Nvidia CEO Remarks

lonQ and other quantumcomputing stocks slid after Nvidia Chief Executive Jensen Huang played down the likely utility of the technology in the near- or medium-term.